The purpose of IRS form W-9 is to gather information from independent contractors (and others) in order to prepare IRS form 1099. That’s it. Completing form W9 does not guarantee you will receive a 1099 because there are other considerations outside the scope of this article.

I’ve always been puzzled why so many view the W-9 form as something to be feared. Some even get angry when they are asked to complete this form because now the income has to be reported. (Note the IRS does expect you to report all your income. Your argument with that is not the point of this article.) IRS forms can be intimidating but the W-9 form isn’t so bad.

As a matter of routine, you should prepare a W-9 form and have it ready when someone you are doing work for requests it. The form itself looks harmless enough, but if it is not completed correctly, can lead to letters from the IRS.

Let’s walk through completing a form.

Download the most current version of form W-9

To make sure you are using the most current version of the W9 form, do a browser search for “IRS form W-9”. The first result that appears should be a link to the form on the IRS website. Download the form to your computer. (I’m not providing a direct link to the form because you should always use the most current version of the form issued by the IRS, hence the browser search.)

How does the IRS know you and your business?

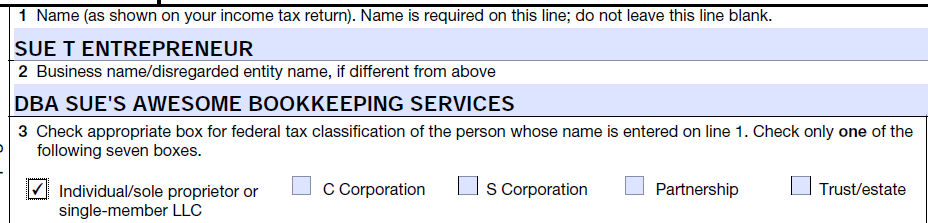

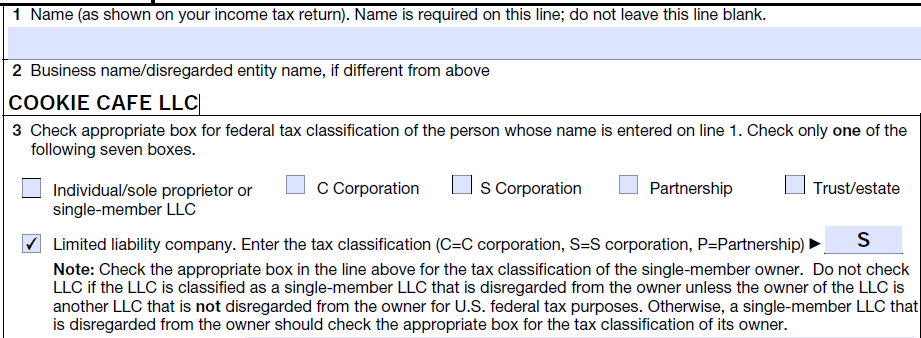

Look at the first two lines, name and business name.

The correct way to complete these lines depends on your business entity and how you are registered with the IRS. If you are a sole proprietor or single member LLC, see the image below for the correct way to enter your information. It’s important to note that your name on line one must match what is on your social security card.

This is the number one reason why the IRS sends out letters regarding errors on 1099 forms. Your name and the business name entered on this form MUST match what the IRS has on file. No exceptions.

How is your business taxed?

Next, look at line three above. Again, it’s important to select the right box for your entity type. If you are unsure, please ask your tax pro or bookkeeper for assistance. Don’t guess!

In the image below, Cookie Cafe LL is a LLC taxed as a S-corp. Note that in section three, you can only check ONE box. Remember, this must match the IRS records.

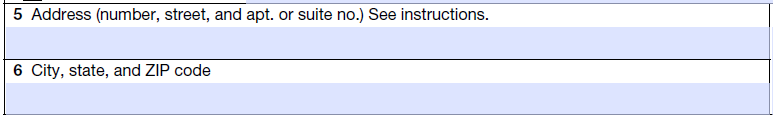

Where do you receive mail?

Lines five and six are super easy. Enter the mailing address you use for your business.

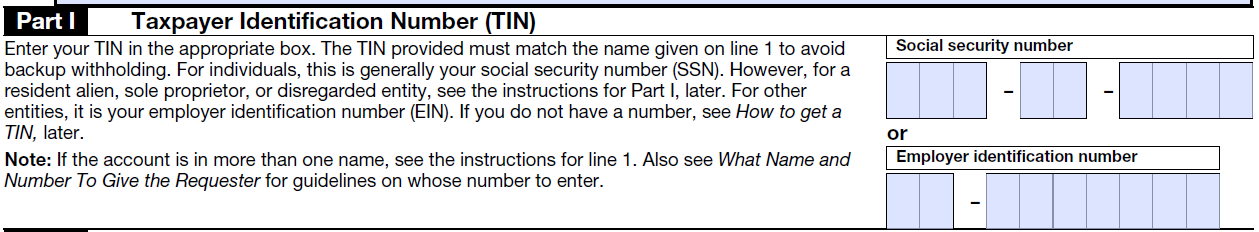

What’s your tax ID?

The next section, part one, is your taxpayer identification number. This is the EIN issued to you by the IRS. If you are a sole proprietor or single member LLC, I urge you to get a EIN to protect your social security number. The fewer people that have your social security number the better. You can get a EIN for free from the IRS right now using this link.

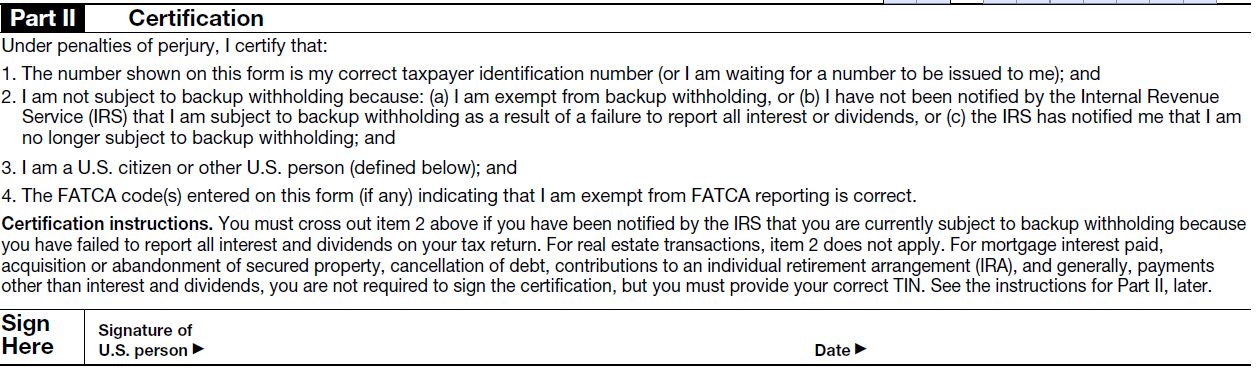

Sign here

Finally, sign the form. You can either print the form, sign and date it, and scan it to PDF so you can email it to those who are requesting the form, or use a digital signature.

If anything changes with your business – address, tax entity type – be sure to complete an updated form and provide it to those you are currently doing work for.

Don’t be “that” person

One final note: in the image above, you see something about backup withholding. Backup withholding can happen in a couple ways. First, if you’ve annoyed the IRS by not reporting all your income and/or owing them money, they may send you a letter stating you are subject to backup withholding. Currently, that’s 25% of what you are being paid. That means whoever is paying you is required to withhold 25% of what they owe you and send it to the IRS on your behalf. It’s a big nuisance for the person paying you. Huge.

The second way backup withholding happens is by refusing to provide a completed IRS form W-9 when someone you do work for requests it. According to IRS regulations, if anyone you are paying refuses to complete IRS form W-9, that money is now subject to backup withholding. If you are audited by the IRS and they happen to notice you did not issue IRS form 1099 to your independent contractors because they refused to provide a W-9 form, all sorts of problems can ensue. Why? Because the IRS thinks there’s unreported income on the part of your independent contractors and now they too will likely be audited. You may also be fined for not only only failing to issue IRS form 1099, but not doing the backup withholding.

How can you avoid backup withholding? Report your income and pay your taxes. Avoid penalties by asking your graphic designer, accountant, attorney, business coach, virtual assistant, landlord, etc, to complete form W-9 when you hire them and before they do ANY work. If they refuse to complete the form, don’t hire them. Don’t let them create tax and legal problems for your business. If you are asked to complete form W-9, do it. Don’t be “that” person who creates tax and legal issues for clients and customers.

As with all things tax, it’s complicated. For more details about IRS form W-9, see their instructions here.