Category: Blog

-

The Secret to Receiving that Big Tax Refund

This is the time of year when dozens of articles are published purporting to have the secret to receiving that big tax refund. Some of the articles make it sound like tax professionals are hiding the answer from you. I’m sorry to say there is no “easy” button when it comes to that big tax…

-

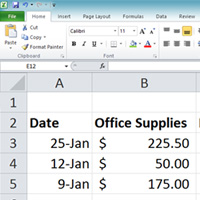

Cash Flow

Cash flow. It is the backbone of your business. If you don’t learn to manage the money coming into and leaving your business it is nearly impossible to be successful. Just because you have a positive bank balance this week does not mean that you can afford to spend it on the latest and greatest…